While most earnings traders were drawing triangles, I was doing math—and it paid.

On January 15, I put on a volatility arbitrage trade in J.B. Hunt Transport Services ($JBHT) that produced a clean, repeatable win in under 24 hours.

No chart patterns. No directional bias. No “support turning into resistance.”

Just mispriced volatility—and a market that consistently (but not always) overestimates post-earnings movement.

Here’s how the trade worked, why most earnings traders never saw it coming, and why this edge keeps repeating.

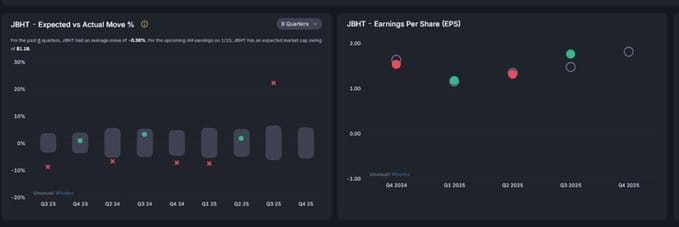

Historical Expected Earnings Moves vs Actual Moves

The Setup: When the Market Overpaid for Fear JBHT was scheduled to report earnings after the close on January 15.

Into the close, the options market was pricing an ~7% expected move, based on the at-the-money straddle.

That number looked reasonable—until you accounted for volatility crush.

Earnings introduce uncertainty. Once earnings are released, that uncertainty disappears. Implied volatility collapses—every time.

Most traders acknowledge this concept. Very few quantify it.

Using historical JBHT earnings data and a two-expiration volatility model, I estimated the true post-earnings expected move closer to 3-4%.

That gap matters.

It meant the market was overpricing insurance—and when insurance is overpriced, you sell it.

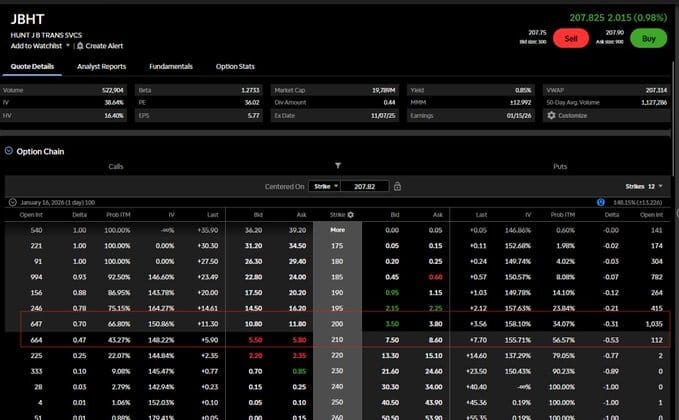

JBHT Options Chain Pre-Earnings

The Strategy: Selling Overpriced Volatility

When the market’s implied move (after adjusting for vol crush) exceeds the realistic expected move, the correct structure is a short volatility trade.

I used a defined-risk iron condor:

Short call spread above the calculated expected move

Short put spread below the calculated expected move

Protective wings one strike beyond to cap risk

No guessing. No directional bias. Risk defined before entry.

Trade details:

Entry: January 15, 3:55 PM ET

Premium collected: $410

Max risk: $590

Structure: $10-wide iron condor

I entered as close to the bell as possible to eliminate intraday noise. This trade depended on one thing only: the earnings event.

Post-Earnings Trade and Options Payoff Diagram

The Result: Volatility Collapsed on Schedule

JBHT reported earnings after the close.

Trading was noisy overnight - that's normal. But the real price discovery (and liquidity) occurs when the markets are fully open.

Next morning: Stock priced remained well below implied move and option implied volatility collapsed exactly as modeled.

By 9:45 AM, the position was deep in profit. I closed at 9:50 AM for $100 resulting in a $310, +76% profit.

Time in trade: ~18 hours

Driver of profit: Vol crush + theta decay

Luck involved: None

This outcome wasn’t surprising. It was expected.

Why This Works (And Why Most Earnings Traders Lose)

Most earnings traders fall into one of two camps:

1. Directional gamblers using charts Buying calls or puts because of “bull flags” or “breakouts” into earnings is just a coin flip with leverage.

2. Blind premium sellers Selling options without modeling expected move vs. implied move is guessing with better marketing.

Neither approach has a repeatable edge.

This one does.

The edge comes from:

Modeling volatility crush

Comparing historical vs. implied earnings moves

Structuring defined-risk trades

Exiting immediately after the event

Charts are irrelevant.

The Only Metrics That Matter

If you want to do this correctly, you need:

ATM straddle pricing for the front two expirations

Historical earnings move distribution

A volatility crush adjustment model

If your calculated move is smaller than the market’s implied move → sell volatility. If it’s larger → buy volatility.

Simple. Difficult. Repeatable.

My Non-Negotiable Rules

Enter at the close

Exit by 10:00 AM post-earnings

Never risk more than 2-3% per event

No exceptions.

The Reality Most Traders Avoid

Earnings trading isn’t about predicting direction. It’s about pricing risk more accurately than the market.

If you’re trading earnings based on chart patterns, you’re not trading—you’re hoping.

GammaReaper doesn’t chase moves. GammaReaper harvests mispriced volatility.

Published on 1.17.26